The purpose of this Companion Policy (the Policy) is to help you understand how the Canadian securities regulatory authorities (CSA or we) interpret or apply certain provisions of National Instrument 81-106 Investment Fund Continuous Disclosure (the Instrument).

Companion Policy to NI 81-106 Investment Fund Continuous Disclosure

Companion Policy to NI 81-106 Investment Fund Continuous Disclosure

Part 1 Purpose and Application of the Companion Policy

Section 1.2

Application

(1) The Instrument applies to investment funds. The general nature of an investment fund is that the money invested in it is professionally managed on the basis of a stated investment policy, usually expressed in terms of investment objectives and strategies, and is invested in a portfolio of securities. The fund has the discretion to buy and sell investments within the constraints of its investment policy. Investment decisions are made by a manager or portfolio adviser acting on behalf of the fund. An investment fund provides a means whereby investors can have their money professionally managed rather than making their own decisions about investing in individual securities.

(2) An investment fund generally does not seek to obtain control of or become involved in the management of companies in which it invests. Exceptions to this include labour sponsored or venture capital funds, where some degree of involvement in the management of the investees is an integral part of the investment strategy.

Investment funds can be distinguished from holding companies, which generally exert a significant degree of control over the companies in which they invest. They can also be distinguished from the issuers known as “Income Trusts” which generally issue securities that entitle the holder to net cash flows generated by (i) an underlying business owned by the trust or other entity, or (ii) the income- producing property owned by the trust or other entity. Examples of entities that are not investment funds are business income trusts, real estate investment trusts and royalty trusts.

(3) Investment funds that meet the definition of “mutual fund” in securities legislation – generally because their securities are redeemable on demand or within a specified period after demand at net asset value per security – are referred to as mutual funds. Other investment funds are generally referred to as non-redeemable investment funds. The definition of “non-redeemable investment fund” included in this instrument summarises the concepts discussed above. Because of their similarity to mutual funds, they are subject to similar reporting requirements. Examples include closed-end funds, funds traded on exchanges with limited redeemability, certain limited partnerships investing in portfolios ofsecurities such as flow-through shares, and scholarship plans (other than self- directed RESPs as defined in OSC Rule 46-501 Self-Directed Registered Education Savings Plans).

(4) Labour sponsored and venture capital funds may or may not be considered to be mutual funds depending on the requirements of the provincial legislation under which they are established (for example, shares of Ontario labour sponsored funds are generally redeemable on demand, while shares of British Columbia employee venture capital corporations are not). Nevertheless, these issuers are investment funds and must comply with the general disclosure rules for investment funds as well as specific requirements for labour sponsored and venture capital funds included in Part 8 of this Instrument.

Companion Policy to NI 81-106 Investment Fund Continuous Disclosure

Part 1 Purpose and Application of the Companion Policy

Section 1.3

Definitions

(1) A term used in the Instrument and defined in the securities statute of a local jurisdiction has the meaning given to it in that statute unless (a) the definition in that statute is restricted to a specific portion of the statute that does not govern continuous disclosure, or (b) the context otherwise requires.

(2) For instance, the term “material change” is defined in local securities legislation of most jurisdictions. The CSA consider the meaning given to this term in securities legislation to be substantially similar to the definition set out in the Instrument.

(3) The Instrument uses accounting terms that may be defined or referred to in Canadian GAAP applicable to publicly accountable enterprises. Some of these terms may be defined differently in securities legislation. National Instrument 14- 101 Definitions provides that a term used in the Instrument and defined in the securities statute of a local jurisdiction has the meaning given to it in the statute unless the definition in that statute is restricted to a specific portion of the statute, or the context otherwise requires.

Companion Policy to NI 81-106 Investment Fund Continuous Disclosure

Part 1 Purpose and Application of the Companion Policy

Section 1.4

Plain Language Principles

The CSA believe that plain language will help investors understand an investment fund’s disclosure documents so that they can make informed investment decisions. You can achieve this by

- using short sentences

- using definite, everyday language

- using the active voice

- avoiding unnecessary words

- organizing the document into clear, concise sections, paragraphs and sentences

- avoiding jargon

- using personal pronouns to speak directly to the reader

- avoiding reliance on glossaries and defined terms unless it helps to understand the disclosure

- using technical terms only where necessary and explaining those terms clearly

- avoiding boilerplate wording

- using concrete terms and examples

- using charts and tables where it makes the disclosure easier to understand.

Companion Policy to NI 81-106 Investment Fund Continuous Disclosure

Part 1 Purpose and Application of the Companion Policy

Section 1.5

Signature and Certificates

The directors, trustee or manager of an investment fund are not required to file signed or certified continuous disclosure documents. They are responsible for the information in the investment fund’s disclosure documents whether or not a document is signed or certified, and it is an offence under securities legislation to make a false or misleading statement in any required document.

Companion Policy to NI 81-106 Investment Fund Continuous Disclosure

Part 1 Purpose and Application of the Companion Policy

Section 1.6

Filings on SEDAR

All documents required to be filed under the Instrument must be filed in accordance with National Instrument 13-101 System for Electronic Document Analysis and Retrieval (SEDAR).

Companion Policy to NI 81-106 Investment Fund Continuous Disclosure

Part 1 Purpose and Application of the Companion Policy

Section 1.7

Corporate Law Requirements

Some investment funds may be subject to requirements of corporate law that address matters similar to those addressed by the Instrument, and which may impose additional or more onerous requirements. For example, applicable corporate law may require investment funds to deliver annual financial statements to securityholders. This Instrument cannot provide exemptions from these requirements.

Companion Policy to NI 81-106 Investment Fund Continuous Disclosure

Part 2 Financial Statements

Section 2.1

Interrelationship of Financial Statements Statements with Canadian GAAP

(1) [Repealed]

(1.1) Subsection 2.6(2) of the Instrument, applicable to financial years beginning on or after January 1, 2014, refers to Canadian GAAP for publicly accountable enterprises, which is IFRS incorporated into the Handbook, contained in Part I of the Handbook. IFRS is defined in National Instrument 14-101 Definitions as the standards and interpretations adopted by the International Accounting Standards Board.

Subsection 2.6(1) of the Instrument, applicable to financial years beginning before January 1, 2014, refers to Canadian GAAP as applicable to public enterprises, which the CSA considers to be the standards in Part V of the Handbook.

(2) The CSA believe that an investment fund’s financial statements must include certain information, at a minimum, in order to provide full disclosure. The Instrument sets out these minimum requirements, but does not mandate all the required disclosure. Canadian GAAP applicable to publicly accountable enterprises also contains minimum requirements relating to the content of financial statements. An investment fund’s financial statements must meet these requirements as well.In some cases, the Instrument prescribes line items that may already be required by Canadian GAAP, but these line items are expressed more specifically for the activities of an investment fund. For example, Canadian GAAP requires a “trade and other receivables” line item on the statement of financial position, but the Instrument requires accounts receivable to be broken down into more specific categories. In other instances, the line items prescribed in the Instrument are in addition to those in Canadian GAAP.

While the Instrument prescribes line items, it does not prescribe the order in which those line items are presented. Investment funds should present line items, as well as any subtotals or totals, in a logical order that will contribute to a reader’s overall understanding of the financial statements.

Investment funds are responsible for disclosing all material information concerning their financial position and financial performance in the financial statements.

(3) [Repealed].

Companion Policy to NI 81-106 Investment Fund Continuous Disclosure

Part 2 Financial Statements

Section 2.2

Filing Deadline for Annual Annual Financial Statements and Auditor’s Report

Section 2.2 of the Instrument sets out the filing deadline for annual financial statements. While section 2.2 of the Instrument does not address the auditor’s report date, investment funds are encouraged to file their annual financial statements as soon as possible after the date of the auditor’s report.

Companion Policy to NI 81-106 Investment Fund Continuous Disclosure

Part 2 Financial Statements

Section 2.4

Length of Financial Year Year

For the purposes of the Instrument, unless otherwise expressly provided, references to a financial year apply regardless of the length of that year. The first financial year of an investment fund commences on the date of its incorporation or organization and ends at the close of that year.

Companion Policy to NI 81-106 Investment Fund Continuous Disclosure

Part 2 Financial Statements

Section 2.5

Contents of Statement of of Comprehensive Income

The amount of fund expenses waived or paid by the manager or portfolio adviser of the investment fund disclosed in the statement of comprehensive income excludes amounts waived or paid due to an expense cap that would require securityholder approval to change.

Companion Policy to NI 81-106 Investment Fund Continuous Disclosure

Part 2 Financial Statements

Section 2.5.1

Disclosure of Investment Portfolio

(1) The term “statement of investment portfolio” is used to describe the disclosure required by section 3.5 of the Instrument. As this term is not used in the Handbook, preparers may refer to it as a “schedule of investment portfolio” within a complete set of investment fund financial statements. Regardless of how the disclosure is described, sections 2.1 and 2.3 of the Instrument require it to be included within a complete set of investment fund financial statements, and subsection 2.1(2) of the Instrument requires annual financial statements to be accompanied by an auditor’s report, for the purposes of securities legislation.

If financial statements for more than one investment fund are bound together, Part 7 of the Instrument requires all of the information pertaining to each investment fund to be presented together and not intermingled with information relating to another investment fund. The CSA is of the view that this requirement applies equally to the portfolio disclosure, which should be presented together with the other financial information relating to the investment fund.

(2) If an investment fund invests substantially all of its assets directly, or indirectly through the use of derivatives, in securities of one other investment fund, the investment fund should provide in the statement of investment portfolio, or the notes to that statement, additional disclosure concerning the holdings of the other investment fund, as available, in order to assist investors in understanding the actual portfolio to which the investment fund is exposed. The CSA is of the view that such disclosure is consistent with the requirements in the Handbook relating to financial instrument disclosure.

Companion Policy to NI 81-106 Investment Fund Continuous Disclosure

Part 2 Financial Statements

Section 2.6

Disclosure of Soft Dollars Dollars

The notes to the financial statements of an investment fund must contain disclosure of soft dollar amounts when such amounts are ascertainable. When calculating these amounts, investment funds should include the quantifiable value of goods and services, beyond the amount attributed to order execution, received directly from the dealer executing the fund’s portfolio transactions, or from a third party.

Companion Policy to NI 81-106 Investment Fund Continuous Disclosure

Part 2 Financial Statements

Section 2.7

Securities Lending Transactions

(1) Section 3.8 of the Instrument imposes certain reporting requirements on investment funds in connection with any securities lending transactions entered into by the investment fund. These requirements were included to ensure that certain aspects of securities lending transactions are disclosed in the same manner.

Generally, in a securities lending transaction, the investment fund is able to call the original securities back at any time, and the securities returned must be the same or substantially the same as the original securities. The investment fund retains substantially all of the risks and rewards of ownership.

(2) [Repealed].

(3) The Canadian securities regulatory authorities consider that, for the purposes of disclosing the gross amount generated from securities lending transactions in the notes to the financial statements of an investment fund pursuant to subsection 3.8(4) of the Instrument, all amounts generated in relation to the securities lending transactions of the investment fund must be disclosed, prior to the deduction of any amounts paid to securities lending agents or other service providers pursuant to any revenue sharing arrangement. Furthermore, for the purposes of subsection 3.8(4) of the Instrument, the Canadian securities regulatory authorities are of the view that any proceeds generated as a result of investing the collateral delivered to the investment fund in connection with a securities lending transaction form part of the gross amount from the securities lending transaction and must be included in the amount disclosed in the notes to the financial statements under subsection 3.8(4) of the Instrument.

Companion Policy to NI 81-106 Investment Fund Continuous Disclosure

Part 2 Financial Statements

Section 2.8

Change in Year End End

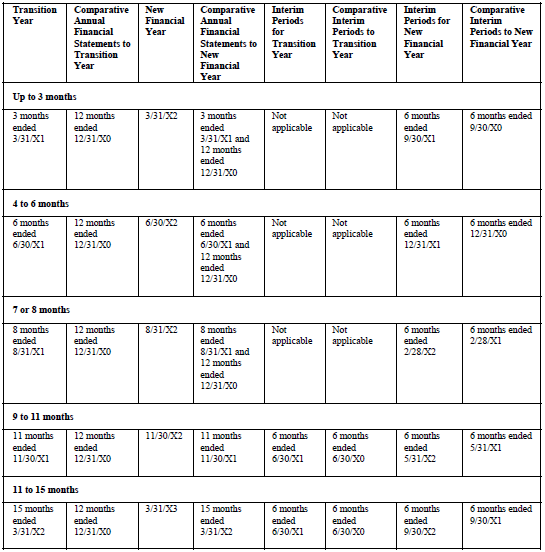

(1) The change in year end reporting requirements are adopted from National Instrument 51-102, with appropriate modifications to reflect that investment funds report on a six month interim period.

(2) The definition of “interim period” in the Instrument differs from the definition of this term in National Instrument 51-102. An investment fund cannot have more than one interim period in a transition year.

(3) The interim financial report for the new financial year will have comparatives from the corresponding months in the preceding year, whether or not they arefrom the transition year or from the old financial year, they were previously prepared or not, or they straddle a year-end.

(4) If an investment fund voluntarily reports on a quarterly basis, it should follow the requirements set out in National Instrument 51-102 for a change in year end, with appropriate modifications.

(5) Appendix A to this Policy outlines the financial statement filing requirements under section 2.9 of the Instrument for an investment fund that changes its year end.

Companion Policy to NI 81-106 Investment Fund Continuous Disclosure

Part 3 Auditors and their Reports

Section 3.1

Acceptable Auditor

Securities legislation in most jurisdictions prohibits a regulator or securities regulatory authority from issuing a receipt for a prospectus if it appears that a person or company who has prepared any part of the prospectus, or is named as having prepared or certified a report used in connection with a prospectus, is not acceptable.

Investment funds that are reporting issuers, and their auditors, should refer to National Instrument 52-108 Auditor Oversight for requirements relating to auditor oversight by the Canadian Public Accountability Board.

Companion Policy to NI 81-106 Investment Fund Continuous Disclosure

Part 3 Auditors and their Reports

Section 3.2

Modification of Opinion

(1) The Instrument prohibits an auditor’s report from expressing a modified opinion under Canadian GAAS. A modification of opinion includes a qualification of opinion, an adverse opinion, and a disclaimer of opinion.

(2) Part 17 of the Instrument permits the regulator or securities regulatory authority to grant exemptive relief from the Instrument, including the requirement that an auditor’s report express an unmodified opinion or other similar communication that would constitute a modification of opinion under Canadian GAAS. However, we will generally recommend that such exemptive relief should not be granted if the modification of opinion or other similar communication is

(a) due to a departure from accounting principles permitted by the Instrument, or

(b) due to a limitation in the scope of the auditor’s examination that

(i) results in the auditor being unable to form an opinion on the financial statements as a whole,

(ii) is imposed or could reasonably be eliminated by management, or

(iii) could reasonably be expected to be recurring.

Companion Policy to NI 81-106 Investment Fund Continuous Disclosure

Part 3 Auditors and their Reports

Section 3.3

Auditor’s Involvement with Management Management Reports of Fund Performance

Investment funds’ auditors are expected to comply with the Handbook with respect to their involvement with the annual and interim management reports of fund performance required by the Instrument as these reports contain financial information extracted from the financial statements.

Companion Policy to NI 81-106 Investment Fund Continuous Disclosure

Part 3 Auditors and their Reports

Section 3.4

Auditor Involvement with Interim Interim Financial Reports

(1) The board of directors of an investment fund that is a corporation or the trustees of an investment fund that is a trust, in discharging their responsibilities for ensuring a reliable interim financial report, should consider engaging an external auditor to carry out a review of the interim financial report.

(2) Section 2.12 of the Instrument requires an investment fund to disclose if an auditor has not performed a review of the interim financial report to disclose if an auditor was unable to complete a review and why, and to file a written report from the auditor if the auditor performed a review and expressed a reservation in the auditor’s interim review report. No positive statement is required when an auditor performed a review and provided an unqualified communication. If an auditor was engaged to perform a review on an interim financial report applying review standards set out in the Handbook, and the auditor was unable to complete the review, the investment fund’s disclosure of the reasons why the auditor was unable to complete the review should normally include a discussion of

(a) inadequate internal control,

(b) a limitation on the scope of the auditor’s work, or

(c) a failure of management to provide the auditor with written representations the auditor believes are necessary.

(3) The terms “review” and “written review report” used in section 2.12 of the Instrument refer to the auditor’s review of and report on an interim financial report using standards for a review of an interim financial report by the auditor as set out in the Handbook.

(4) The Instrument does not specify the form of notice that should accompany an interim financial report that has not been reviewed by the auditor. The noticeaccompanies, but does not form part of, the interim financial report. We expect that the notice will normally be provided on a separate page appearing immediately before the interim financial report, in a manner similar to an auditor’s report that accompanies annual financial statements.

Companion Policy to NI 81-106 Investment Fund Continuous Disclosure

Part 4 Delivery of Financial Statements and Management Reports of Fund Performance

Section 4.1

Delivery Instructions

(1) The Instrument gives investment funds the following choices for the delivery of financial statements and management reports of fund performance:

(a) send these documents to all securityholders;

(b) obtain standing instructions from securityholders with respect to the documents they wish to receive; or

(c) obtain annual instructions from securityholders by sending them an annual request form they can use to indicate which documents they wish to receive.The choices are intended to provide some flexibility concerning the delivery of continuous disclosure documents to securityholders. An investment fund can use any combination of the delivery options for its securityholders. However, the Instrument specifies that once an investment fund chooses option (b) for a securityholder, it cannot switch back to option (c) for that securityholder at a later date. The purpose of this requirement is to encourage investment funds to obtain standing instructions and to ensure that if a securityholder provides standing instructions, the investment fund will abide by those instructions unless the securityholder specifically changes them.

(2) When soliciting delivery instructions from a securityholder, an investment fund can deem no response from the securityholder to be a request by the securityholder to receive all, some or none of the documents listed in subsection 5.1(2) of the Instrument. When soliciting delivery instructions, an investment fund should make clear what the consequence of no response will be to its securityholders.

(3) Investment funds should solicit delivery instructions sufficiently ahead of time so that securityholders can receive the requested documents by the relevant filing deadline. Securityholders should also be given a reasonable amount of time to respond to a request for instructions. Investment funds should provide securityholders with complete contact information for the investment fund, including a toll-free telephone number or a number for collect calls.

(4) Investment funds under common management can solicit one set of delivery instructions from a securityholder that will apply to all of the funds in the same fund family that the securityholder owns. If a securityholder has given an investment fund standing delivery instructions and then later acquires the securities of another investment fund managed by the same manager, the newly acquired fund can rely on those standing instructions.

(5) The Instrument requires investment funds to deliver the quarterly portfolio disclosure and the proxy voting record to securityholders upon request, but does not require investment funds to solicit delivery instructions from securityholders with respect to this disclosure. Investment funds are obligated to state on the first page of their management reports of fund performance that this disclosure is available.

Companion Policy to NI 81-106 Investment Fund Continuous Disclosure

Part 4 Delivery of Financial Statements and Management Reports of Fund Performance

Section 4.2

Communication with Beneficial Owners

Generally, investment funds must apply the procedures set out in National Instrument 54-101 Communication with Beneficial Owners of Securities of a Reporting Issuer for the purposes of Part 5 of the Instrument, but an exemption from National Instrument 54-101 is available to investment funds that have beneficial owner information.

We recognize that different types of investment funds have different access to beneficial owner information (for example, mutual funds are more likely to have beneficial owner information than exchange-traded funds) and that the procedures in National Instrument 54-101 may not be efficient for every investment fund. We intend the provisions in Part 5 of the Instrument to provide investment funds with flexibility to communicate directly with the beneficial owners of their securities. If an investment fund has the necessary information to communicate directly with one or more beneficial owners of its securities, it can do so, even though it may need to rely on National Instrument 54-101 to communicate with other beneficial owners of its securities.

Companion Policy to NI 81-106 Investment Fund Continuous Disclosure

Part 4 Delivery of Financial Statements and Management Reports of Fund Performance

Section 4.3

Binding –

For the purposes of delivery to a securityholder, the Instrument permits more than one management report of fund performance to be bound together if the securityholder owns all of the funds to which the management reports relate. There is no prohibition in the Instrument against binding the management report of fund performance with the financial statements for one investment fund for the purposes of delivering these documents to a securityholder who has requested them.

Companion Policy to NI 81-106 Investment Fund Continuous Disclosure

Part 4 Delivery of Financial Statements and Management Reports of Fund Performance

Section 4.4

Electronic Delivery

Any documents required to be sent under the Instrument may be sent by electronic delivery, as long as such delivery is made in compliance with National Policy 11-201 Delivery of Documents by Electronic Means and, in Quebec, Quebec Staff Notice The Delivery of Documents by Electronic Means. In particular, the annual reminder required by section 5.2 and the request form required by section 5.3 of the Instrument may be given in electronic form and may be combined with other notices. Request forms and notices may alternatively be sent with account statements or other materials sent to securityholders by an investment fund.

Companion Policy to NI 81-106 Investment Fund Continuous Disclosure

Part 4 Delivery of Financial Statements and Management Reports of Fund Performance

Section 4.5

Website Disclosure

The Instrument does not specify the length of time that continuous disclosure documents must remain on an investment fund’s website. In the CSA’s view, the documents should stay on the website for a reasonable length of time, and at least until they are replaced by more current versions.

Companion Policy to NI 81-106 Investment Fund Continuous Disclosure

Part 5 Independent Valuations

Section 5.1

Independent Valuations

(1) Part 8 of the Instrument is designed to address the concerns raised by labour sponsored or venture capital funds that disclosing a fair value for their venture investments may disadvantage the private companies in which they invest. Section 8.2 permits alternative disclosure by a labour sponsored or venture capital fund of its statement of investment portfolio. Labour sponsored or venture capital funds must disclose the individual securities in which they invest, but may aggregate all changes from costs of the venture investments, thereby only showing an aggregate adjustment from cost to fair value for these securities. This alternative disclosure is only permitted if the labour sponsored or venture capital fund has obtained an independent valuation in accordance with Part 8 of the Instrument.

(2) The CSA expect the independent valuator’s report to provide either a number or a range of values which the independent valuator considers to be a fair and reasonable expression of the value of the venture investments or of the net asset value of the labour sponsored or venture capital fund. The independent valuation should include a critical review of the valuation methodology and an assessment of whether it was properly applied. A report on compliance with stated valuation policies and practices cannot take the place of an independent valuation.The valuation report should disclose the scope of the review, including any limitations on the scope, and the implications of these limitations on the independent valuator’s conclusion.

(3) The independent valuator should refer to the reporting standards of the Canadian Institute of Chartered Business Valuators for guidance.

(4) A labour sponsored or venture capital fund obtaining an independent valuation should furnish the independent valuator with access to its manager, advisers and all material information in its possession relevant to the independent valuation.

Companion Policy to NI 81-106 Investment Fund Continuous Disclosure

Part 5 Independent Valuations

Section 5.2

Independent Valuators

(1) It is a question of fact as to whether a valuator is independent of the labour sponsored or venture capital fund. In determining the independence of the valuator, a number of factors may be relevant, including whether

(a) the valuator or an affiliated entity has a material financial interest in future business in respect of which an agreement, commitment or understanding exists involving the fund or a person or company listed in paragraph (2)(a); or

(b) the valuator or its affiliated entity is a lender of a material amount of indebtedness to any of the issuers of the fund’s illiquid investments.

(2) The CSA would generally consider a valuator not to be independent of a labour sponsored or venture capital fund where

(a) the valuator or an affiliated entity of the valuator is

(i) the manager of the fund,

(ii) a portfolio adviser of the fund,

(iii) an insider of the fund,

(iv) an associate of the fund,

(v) an affiliated entity of the fund, or

(vi) an affiliated entity of any of the persons or companies named in this paragraph (a);

(b) the compensation of the valuator or an affiliated entity of the valuator depends in whole or in part upon an agreement, arrangement or understanding that gives the valuator, or its affiliated entity, a financial incentive in respect of the conclusions reached in the valuation; or

(c) the valuator or an affiliated entity of the valuator has a material investment in the labour sponsored or venture capital fund or in a portfolio asset of the fund.

Companion Policy to NI 81-106 Investment Fund Continuous Disclosure

Part 6 Proxy Voting Disclosure for Portfolio Securities Held

Section 6.1

Proxy Voting Disclosure

(1) An investment fund’s manager, acting on the investment fund’s behalf, has the right and obligation to vote proxies relating to the investment fund’s portfolio securities. As a practical matter, the manager may delegate this function to the investment fund’s portfolio adviser as part of the adviser’s general management of investment fund assets. In either case, the manager or portfolio adviser voting proxies on behalf of an investment fund must do so in a manner consistent with the best interests of the fund and its securityholders.

(2) Because of the substantial institutional voting power held by investment funds, the increasing importance of the exercise of that power to securityholders, and the potential for conflicts of interest with respect to the exercise of proxy voting, we believe that investment funds should disclose their proxy voting policies and procedures, and should make their actual proxy voting records available to securityholders.

(3) The Instrument requires that the investment fund establish policies and procedures for determining whether, and how, to vote on any matter for which the investment fund receives proxy materials for a meeting of securityholders of an issuer. The CSA consider an investment fund to “receive” a document when it is delivered to any service provider or to the investment fund in respect of securities held beneficially by the investment fund. Proxy materials may be delivered to a manager, a portfolio adviser or sub-adviser, or a custodian. All of these deliveries are considered delivered “to” the investment fund.

(4) The Instrument requires an investment fund to maintain an annual proxy voting record as of June 30 and to post this to the fund’s website if it has one. However, investment funds may choose to disclose their proxy votes throughout the course of the year, and may also choose to disclose how they intend to vote prior to the shareholder meeting.

Companion Policy to NI 81-106 Investment Fund Continuous Disclosure

Part 6 Proxy Voting Disclosure for Portfolio Securities Held

Section 6.2

Proxy Voting Policies and and Procedures

(1) Section 10.2 of the Instrument sets out, in general terms, what the securities regulatory authorities consider to be minimum policies and procedures for the proxy voting process. Investment funds are responsible for adopting any additional policies relevant to their particular situation. For example, investment funds should consider whether they require any specific policies dealing with shareholder meetings of issuers resident in other countries.

(2) An investment fund sometimes needs to vote securities held by it in order to protect its interests in connection with corporate transactions or developments relating to the issuers of its portfolio securities. The manager and portfolio adviser, or the agent of the investment fund administering a securities lending program on behalf of the investment fund, should monitor corporate developments relating to portfolio securities that are loaned by the investment fund in securities lending transactions, and take all necessary steps to ensure that the investment fund can exercise a right to vote the securities when necessary.

Companion Policy to NI 81-106 Investment Fund Continuous Disclosure

Part 7 Material Change

Section 7.1

Material Changes

Determining whether a change is a material change will depend on the specific facts and circumstances surrounding the change. However, the CSA is of the view that

(a) the change of portfolio adviser of an investment fund will generally constitute a material change for the investment fund, and

(b) the departure of a high-profile individual from the employ of a portfolio adviser of an investment fund may constitute a material change for the investment fund, depending on how prominently the investment fund featured that individual in its marketing. An investment fund that emphasized the ability of a particular individual to encourage investors to purchase the fund could not later take the position that the departure of that individual was immaterial to investors and therefore not a material change.

Companion Policy to NI 81-106 Investment Fund Continuous Disclosure

Part 7 Material Change

Section 7.2

Confidential Material Change Report Report

The CSA are of the view that in order for an investment fund to file a confidential material change report under Section 11.2 of the Instrument, the investment fund or its manager should advise insiders of the prohibition against trading during the filing period of a confidential material change report and must also take steps to monitor trading activity.

Companion Policy to NI 81-106 Investment Fund Continuous Disclosure

Part 8 Information Circulars

Section 8.1

Sending of Proxies and and Information Circulars

Investment funds are reminded that National Instrument 54-101 prescribes certain procedures relating to the delivery of proxy-related materials sent to beneficial owners of securities.

Companion Policy to NI 81-106 Investment Fund Continuous Disclosure

Part 9 Net Asset Value

Section 9.1

Publication of Net Asset Value Per Security

An investment fund that arranges for the publication of its net asset value per security should calculate its net asset value per security and make the results of that calculation available to the financial press as quickly as is commercially practicable. An investment fund should attempt to meet the deadlines of the financial press for publication in order to ensure that its net asset values per security are publicly available as quickly as possible.

Companion Policy to NI 81-106 Investment Fund Continuous Disclosure

Part 9 Net Asset Value

Section 9.2

Fair Value Guidance

Section 14.2 of the Instrument requires an investment fund to calculate its net asset value based on the fair value of the investment fund’s assets and liabilities. This may differ from the calculation of “current value” for financial statement purposes. Section 3.6 of the Instrument requires an explanation of this difference.While investment funds are required to comply with the definition of “fair value” in the Instrument when calculating net asset value, they may also look to the Handbook for guidance on the measurement of fair value. The fair value principles articulated in the Handbook can be applied by investment funds when valuing assets and liabilities.

Companion Policy to NI 81-106 Investment Fund Continuous Disclosure

Part 9 Net Asset Value

Section 9.4

Determination of Fair Value Value in Calculating Net Asset Value

(1) A market is generally considered active when quoted prices are readily and regularly available from an exchange, dealer, broker, industry group, pricing service or regulatory agency, and those prices reflect actual and regularly occurring market transactions on an arm’s length basis. Accordingly, fair value should not reflect the amount that would be received or paid in a forced transaction, involuntary liquidation or distress sale.

(2) A market is not considered to be active, and prices derived from it may be unreliable for valuation purposes, if, at the time the investment fund begins to calculate its net asset value, any of the following circumstances are present:

- markets on which portfolio securities are principally traded closed several hours earlier (e.g. some foreign markets may close as much as 15 hours before the time the investment fund begins to calculate its net asset value)

- trading is halted

- events occur that unexpectedly close entire markets (e.g. natural disasters, power blackouts, public disturbances, or similar major events)

- markets are closed due to scheduled holidays

- the security is illiquid and trades infrequently.

If an investment fund manager determines that an active market does not exist for a security, the manager should consider whether the last available quoted market price is representative of fair value. If a significant event (i.e. one that may impact the value of the portfolio security) has occurred between the time the last quoted market price was established and the time the investment fund begins to calculate its net asset value, the last quoted market price may not be representative of fair value.

(3) Whether a particular event is a significant event for a security depends on whether the event may affect the value of the security. Generally, significant events fall into one of three categories: (i) issuer specific events – e.g. the resignation of the CEO or an after-hours earnings announcement, (ii) market events – e.g. a natural disaster, a political event, or a significant governmental action like raising interest rates, and (iii) volatility events – e.g. a significant movement in North American equity markets that may directly impact the market prices of securities traded on overseas exchanges.

Whether a market movement is significant is a matter to be determined by the manager through the establishment of tolerance levels which it may choose to base on, for example, a specified intraday and/or interday percentage movementof a specific index, security or basket of securities. In all cases, the appropriate triggers should be determined based on the manager’s own due diligence and understanding of the correlations relevant to each investment fund’s portfolio.

Companion Policy to NI 81-106 Investment Fund Continuous Disclosure

Part 9 Net Asset Value

Section 9.5

Fair Value Techniques

The CSA do not endorse any particular fair value technique as we recognize that this is a constantly evolving process. However, whichever technique is used, it should be applied consistently for a portfolio security throughout the fund complex and reviewed for reasonableness on a regular basis.

Companion Policy to NI 81-106 Investment Fund Continuous Disclosure

Part 9 Net Asset Value

Section 9.6

Valuation Policies and Procedures Procedures

An investment fund’s valuation policy should be approved by the manager’s board of directors. The policies and procedures should describe the process for monitoring significant events or other situations that could call into question whether a quoted market price is representative of fair value. They should also describe the methods by which the manager will review and test valuations to evaluate the quality of the prices obtained as well as the general functioning of the valuation process. The manager should also consider whether its valuation process is a conflict of interest matter as defined in NI 81-107.

Companion Policy to NI 81-106 Investment Fund Continuous Disclosure

Part 10 Calculation of Management Expense Ratio

Section 10.1

Calculation of Management Expense Expense Ratio

(1) Part 15 of the Instrument sets out the method to be used by an investment fund to calculate its management expense ratio (MER). The requirements apply in all circumstances in which an investment fund circulates and discloses an MER. This includes disclosure in a sales communication, a prospectus, a fund facts document, an ETF facts document, an annual information form, financial statements, a management report of fund performance or a report to securityholders.

(2) Paragraph 15.1(1)(a) requires the investment fund to use its “total expenses” (other than distributions if these are an expense for the investment fund) before income taxes for the relevant period as the basis for the calculation of MER. Total expenses, before income taxes, include interest charges and taxes, including sales taxes, GST and capital taxes payable by the investment fund. Withholding taxes need not be included in the MER calculation.

The CSA is of the view that if an investment fund issues debt-like securities or securities that otherwise provide leverage to the fund, payments to holders of these securities should be treated as financing costs from the perspective of the investment fund’s other classes of securities (the classes that benefit from the financing or leverage). These costs should not be excluded from total expenses when calculating the MER of the investment fund’s other classes of securities. Securities that provide leverage generally include preferred shares.Non-optional fees paid directly by investors in connection with the holding of an investment fund’s securities do not have to be included in the MER calculation.

(3) The CSA recognize that an investment fund may incur fees and charges that are not included in total expenses, but that reduce the net asset value and the amount of investable assets of the investment fund. Sales commissions paid by an investment fund in connection with the sale of the investment fund’s securities are an example of such fees and charges. We believe that these fees and charges should be reflected in the MER of the investment fund.

(4) While brokerage commissions and other portfolio transaction costs are expenses of an investment fund for accounting purposes, they are not included in the MER. These costs are reflected in the trading expense ratio.

(5) In its management report of fund performance, an investment fund must disclose historical MERs for five years calculated in accordance with Part 15. If the investment fund has not calculated the historical MERs in the manner required by the Instrument, we are of the view that the change in the method of calculating the MER should be treated in a manner similar to a change in accounting policy underInternational Accounting Standard 8 Accounting Policies, Changes in Accounting Estimates and Errors. Under Canadian GAAP, a change in accounting policy requires a retrospective application of the change for all periods shown. However, the Handbook acknowledges that there may be circumstances where the data needed to restate the financial information is not reasonably determinable.

If an investment fund restates its MER for any of the five years it is required to show, the investment fund should describe this restatement in the first document released and in the first management report of fund performance in which the restated MERs are reported.

If an investment fund does not restate its MER for prior periods because, based on specific facts and circumstances, the information required to do so is not reasonably determinable, the MER for all financial periods ending after the effective date of the Instrument must be calculated in accordance with Part 15. In this case, the investment fund must also disclose

(i) that the method of calculating MER has changed, specifying for which periods the MER has been calculated in accordance with the change;

(ii) that the investment fund has not restated the MER for specified prior periods;

(iii) the impact that the change would have had if the investment fund had restated the MER for the specified prior periods (for example, would theMER have increased or decreased and an estimate of the increase or decrease); and

(iv) a description of the main differences between an MER calculated in accordance with the Instrument and the previous calculations.The disclosure outlined above should be provided for all periods presented until such time as all MERs presented are calculated in accordance with the Instrument.

Companion Policy to NI 81-106 Investment Fund Continuous Disclosure

Appendix A

Examples of Filing Requirements for Changes in Year End

The following examples assume the old financial year ended on December 31, 20X0.