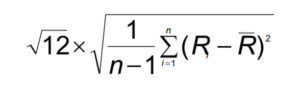

(1) A mutual fund must calculate its standard deviation for the most recent 10 years as follows:

| Standard Deviation |  |

| where | n = 120 months |

(2) For the purposes of subsection (1), a mutual fund must make the calculation with respect to the series or class of securities of the mutual fund that first became available to the public and calculate the “return on investment” for each month using:

(a) the net asset value of the mutual fund, assuming the reinvestment of all income and capital gain distributions in additional securities of the mutual fund, and

(b) the same currency in which the series or class is offered.

Commentary:

For the purposes of Item 2, except for seed capital, the date on which the series or class of securities first became available to the public corresponds or approximately corresponds to the date on which the securities of the series or class were first issued to investors.